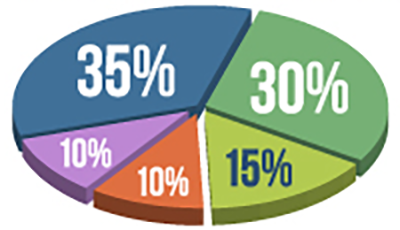

35% Payment History

Late payments may lead to a lower score.

Late payments may lead to a lower score.

Less is more! Lowering debt can be the key to a better credit score.

Opening several accounts in a short time can lower your credit score.

Having experience with different types of credit (e.g., car loan and a credit card) can help your score.

A longer history of responsible credit use will likely lead to a higher score.